Millennial Home Buying Myths Debunked

Millennial Home Buying Myths Debunked

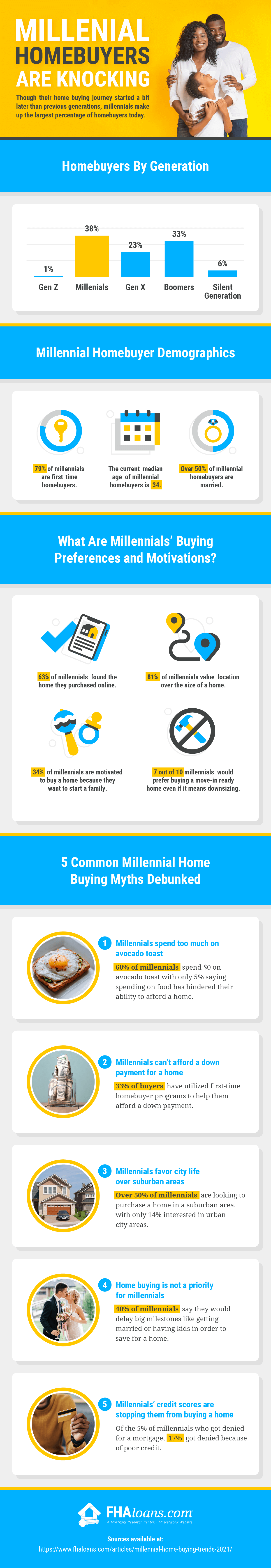

Millennials seem to be the one generation that is always the topic of discussion, but are some of the most misunderstood individuals today. While many seem to think all they’re worried about is their $10 avocado toasts and pumpkin spiced lattes, this generation is actually focused on a lot more—home buying being one of them.

Millennials are currently ages 22 to 39 and with the average median age of homebuyers being 34 years old, they’re taking the home market by storm. In 2020, millennials made up 38 percent of homebuyers and that number is only going to keep growing.

While this may come as a shocker to most, this generation is making homeownership a reality, despite what others may say. Here are a couple myths about millennial homebuyers you need to know in 2021:

1.Millennials favor city life over suburban areas

This couldn’t be more false. In 2020, more than half of millennials were looking in suburban areas to purchase a home, with only 14 percent interested in urban city areas. With many millennials starting to settle down, start families and most now working from home, the city life isn’t as appealing as it once was. Priorities change as we get older, which proves to be true with this generation.

2.Millennials can’t afford a down payment

As one of the generations leading the student loan debt crisis, it’s not surprising to think that millennials couldn’t afford a down payment or a mortgage at that. But, there are many loan programs available to these homebuyers that are helping them achieve their dream of homeownership.

Since many millennials are buying homes for the first time, they’re leaning on first-time homebuyer programs, like FHA loans, to help their affordability. In fact, 33 percent of buyers utilized first-time homebuyer programs in 2020 to help them afford a down payment. With the more relaxed qualifications and the lower down payment requirements, FHA loans continue to be great options for millennial buyers.

3.Home buying is not a priority for millennials

Another false statement. A recent report from Clever revealed that 40% of millennials actually said they would delay other big milestones like getting married or having kids in order to save for a home. This proves that buying a home is in fact a top priority for millennials today.

If you’re a millennial home buyer looking to enter the housing market in 2021, here are a few first-time homebuyer tips to help you on your journey:

1.Look into affordability programs

Many down payment assistance programs are offered at the state level for first-time homebuyers. Remember, with an FHA loan, you only need a 3.5 percent down payment to qualify. Research programs available in your area to see what other help is out there.

2.Shop for an energy-efficient mortgage

Energy-efficient homes remain a top priority amongst millennial home buyers. Energy-efficient mortgage programs are available to homebuyers that allow you to qualify for a higher loan amount to cover the costs of energy-efficient features or upgrades. This will help make homeownership more affordable by lowering operating costs, thus decreasing utility payments.

3.Buy while rates are low

Interest rates are historically low and are projected to remain low and stable throughout 2021. This makes it an ideal time for first-time homebuyers to enter the housing market and receive a great mortgage rate.

To find out more myths about this misunderstood generation, as well as common millennial home buying trends for 2021, check out the visual created by FHA Loans below:

* This is NOT a commitment to lend. Financing example is based on a sales price with a 5% down payment. Mortgage is an FHA loan with 2 points and an interest rate of 5.5% (APR to be determined by a lender). Offer available on select homes purchased between February 1st and February 28th that close by March, 2025. Allen Edwin Homes reserves the right to change prices, incentives, plans & specifications without notice. Buyer must utilize Builders Preferred Lender to receive promotion. Total Closing Cost contribution subject to Seller’s contribution limitations based on Mortgage Programs and loan to value guidelines that are outside Seller’s control. All Loans are subject to loan qualifications of the lender. Rates, terms and conditions are subject to change without notification. Certain loan programs may not qualify for the full incentive. Any unused portion of the funds cannot be applied to cost of home, options, elevation premiums, or lot premiums. Any unused portion will be forfeited. Additional conditions or restrictions apply. See Allen Edwin Homes Sales Professional for more information. Offer expires February 28th, 2025.

Copyright © 2025 Allen Edwin Homes. All Rights Reserved.

Allen Edwin Homes is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account and to provide the products and services you requested from us. We will contact and update you about information related to your home search as well as content that may be of interest to you. By clicking submit on any forms on the allenedwin.com website, you consent to allow www.allenedwin.com to store and process the personal information submitted to provide you the content requested. You may unsubscribe from these communications at any time. For more information on how to unsubscribe, our privacy practices, and how we are committed to protecting and respecting your privacy, please review our Privacy Policy and Terms of Use.