‘Most definitely a myth’ that you have to put 20% down on a home

Inflation is raging. Home prices are rising. How in the world can you afford to put 20% down on a house?

Psst, guess what? You don’t have to make a big down payment to get out of your rental and into the home of your dreams. There’s a lot of low or no down payment options available that make home ownership cost less than rent.

“The 20% down requirement is most definitely a myth,” said AJ Harma, first vice president of mortgage lending at Independent Bank. “I’ve been lending for about 35 years and the vast majority of first-time homebuyers do not have 20% down.

“There are a variety of great options for low down payment solutions, and there are multiple programs that allow for as little as 0% down.”

Once you decide that you can’t afford not to buy a home right now, keep these things in mind for getting into your home with a low down payment:

FHA mortgage loans backed by the Federal Housing Administration allow for down payments as low as 3.5%, for example. Down payments can be as low as 5% on conventional mortgages, or even 3% for first-time homebuyers who meet certain income limits.

There also are zero-down options for active military and veterans, and through Rural Development loans in certain geographic areas. There even are mortgages with 0 to 1% down payments for homebuyers in certain careers such as police, fire, education and health care.

“We have got tons of options,” said Jim Douglass, senior sales counselor with Allen Edwin Homes. “If you want to buy a home right now, we can figure it out.”

Of course, just because you can buy a home with a low down payment doesn’t necessarily mean now is the time. Right? After all, mortgage rates have reached their highest level in two decades.

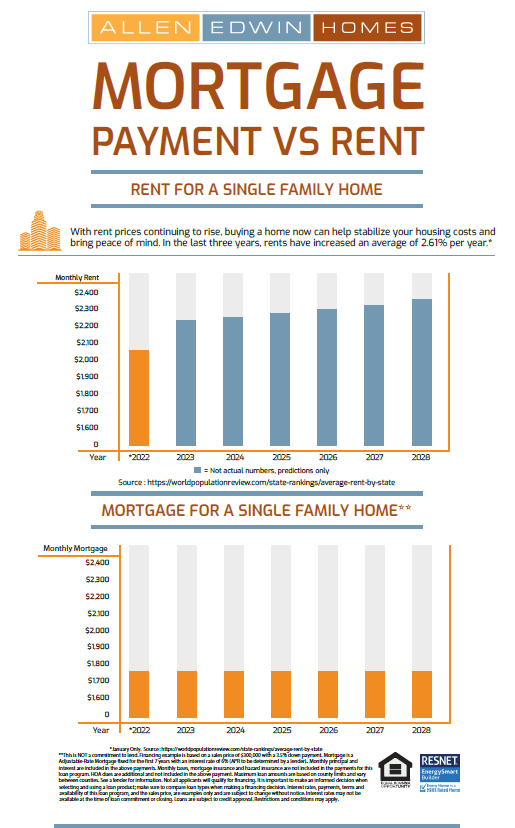

Then again, rent isn’t getting any cheaper. Why keep throwing your money away every month when you could start building wealth for the future by becoming a homeowner?

You could wait and hope home prices or mortgage rates go down. But with an undersupply of homes on the market, prices aren’t going to drop anytime soon. And if interest rates do tick back down, home prices will shoot up even more.

“It’s a scenario in which you almost can’t save (for a larger down payment) fast enough to keep up with real estate appreciation over time,” Harma said. The key is to get into a home and start gaining equity that will pay you back down the road, he said.

“Buying a home is definitely a cornerstone of wealth building. The sooner you can acquire that and start to build on that, the better.”

Slide title

Write your caption hereButton

A 30-YEAR FIXED-RATE MORTGAGE AT 7% ISN’T YOUR ONLY OPTION

Just because a fixed-rate mortgage is the most common home loan doesn’t mean it’s the right loan for you right now. In fact, adjustable rate mortgages, or ARMs, are a smarter choice in the current market, Douglass said.

An ARM gives you a reduced interest rate for a period of time before resetting at a later date to whatever the going mortgage rate is at that future time. Going with a 7

Slide title

Write your caption hereButton

year or 10-year ARM right now will probably get you an interest rate somewhere in the 5s, saving around $400 per month on a typical new home.

On the other hand, every additional $10,000 you make as a down payment on a new home only reduces your monthly mortgage by about $60.

“Let’s say an adjustable rate mortgage dropped your payment $300 a month,” Douglass said. “We’d have to put $50,000 down on the home to get the same bang for your buck.”

BUY DOWN YOUR MORTGAGE RATE INSTEAD OF MAKING A BIGGER DOWN PAYMENT

Even if you have cash available for a big down payment, you might be better off using that money to buy points that lower your mortgage rate up front. One recent Allen Edwin buyer paid an extra $15,000 in closing costs to bring his interest rate down to 5%, saving him several hundred dollars on his monthly payment for years to come.

Had he put that money into the down payment on a 7% mortgage instead, it would have decreased his monthly payment by only about $100.

“The better use of cash was buying the rate down versus throwing money at the down payment,” Douglass said.

Douglass also is seeing buyers go with a 2-1 buydown on their mortgages these days. That means you buy down the rate two percentage points in the first year of your loan and one percentage point in the second year before the mortgage reverts back to the original interest rate, say 7%. There also are other options including a 3-0 buydown that lowers your rate 3% in the first year before going forward at the original rate in subsequent ye

LOCK YOUR RATE WHEN YOU BUILD

Going with a lower down payment requires you to finance more of your home purchase with a mortgage, and if interest rates rise during construction your monthly payment could be impacted. However, Allen Edwin works with preferred lenders that let buyers lock in their interest rate up to 12 months before closing on their new home.

That way, even if rates continue rising, you’ll pay only the rate that you lock in now. And if rates tick down during construction, your locked rate can float back down, too.

Of course, if mortgage rates go down after you’re already in your new home, refinancing is always an option.

“No decision regarding interest rates has to be a permanent decision,” Harma said.

LOOK AT YOUR WHOLE FINANCIAL PICTURE

Let’s say you have a car loan of $500 a month. On the one hand, you could make a bigger down payment on a house and keep your car loan. But with mortgage rates around 7%, you only reduce your house payment by about $60 with every additional $10,000 you put down. Instead of using cash you’ve saved for a down payment on a home, use it to pay off your car loan instead.

Ditto for credit card debt. Paying 7% interest on a mortgage makes a lot more sense than paying 22% on a credit card!

“Look at your total cash flow: Where is all your cash going and what’s the best use of that cash to maximize your monthly expenses?” Douglass said. “It’s a much better use of cash to pay the car off than to put it down on the home. Once we pay off that car loan, that’s $500 a month out of your debt-to-income ratio, so now I can qualify you for more home as well.”

Even though mortgage rates have risen this year, they’re still relatively low in historical terms. When Douglass started working with Allen Edwin nearly 20 years ago, the typical rate was around 6 or 7%, just like it is today. And when Harma started working in the mortgage business in the late 1980s, the going rate was 10%!

So, today’s mortgage rates are still pretty good – definitely still good enough to make buying a home the smarter financial move than renting. After all, you can pay a little bit of interest on a home mortgage, or you can keep sending 100% of your monthly payment straight to your landlord if you continue to rent.

Reach out to Allen Edwin Homes or one of their preferred lenders to learn more about all the smart financing options you have for getting into a new home and building wealth without having to make a huge down payment.

Slide title

Write your caption hereButton

* This is NOT a commitment to lend. Financing example is based on a sales price with a 5% down payment. Mortgage is an FHA loan with 2 points and an interest rate of 5.5% (APR to be determined by a lender). Offer available on select homes purchased between February 1st and February 28th that close by March, 2025. Allen Edwin Homes reserves the right to change prices, incentives, plans & specifications without notice. Buyer must utilize Builders Preferred Lender to receive promotion. Total Closing Cost contribution subject to Seller’s contribution limitations based on Mortgage Programs and loan to value guidelines that are outside Seller’s control. All Loans are subject to loan qualifications of the lender. Rates, terms and conditions are subject to change without notification. Certain loan programs may not qualify for the full incentive. Any unused portion of the funds cannot be applied to cost of home, options, elevation premiums, or lot premiums. Any unused portion will be forfeited. Additional conditions or restrictions apply. See Allen Edwin Homes Sales Professional for more information. Offer expires February 28th, 2025.

Copyright © 2025 Allen Edwin Homes. All Rights Reserved.

Allen Edwin Homes is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account and to provide the products and services you requested from us. We will contact and update you about information related to your home search as well as content that may be of interest to you. By clicking submit on any forms on the allenedwin.com website, you consent to allow www.allenedwin.com to store and process the personal information submitted to provide you the content requested. You may unsubscribe from these communications at any time. For more information on how to unsubscribe, our privacy practices, and how we are committed to protecting and respecting your privacy, please review our Privacy Policy and Terms of Use.